Following on the success of the EURO iSTOXX® Ocean Care 40 Index, Qontigo and SILEX have introduced a US-focused version to track those American companies that are taking initiative towards efficient water management and that have strong environmental policies.

The iSTOXX® USA Ocean Care 40 Index, part of Qontigo’s thematic family, is comprised of 40 large and liquid stocks with the highest Ocean Care KPI score. This rating results from the average score in 12 key performance indicators that aim to assess companies’ efforts to protect our waters and the environment.

Findings1 from the World Bank show that worse-than-thought degradation and contamination have turned rivers, seas and oceans, where a large share of human and industrial waste flows, into vast pools of hidden dangers. Water pollution directly affects lives, while hampering economic growth and social development. The severity of this problem is augmented by the circular effect between deteriorating marine water quality and climate change, with both feeding each other.

Selection process

The iSTOXX USA Ocean Care 40 Index selects companies based on the following KPIs, provided by Sustainalytics:

- Environmental policy (assessment of the company’s commitment to protect the environment)

- Environmental management system

- Biodiversity programs

- Oil spill disclosure and performance

- Water intensity (assessment of the company’s external cost of water-related impacts)

- Hazardous waste management

- Water management programs (programs to reduce fresh-water use)

- Carbon intensity

- Operations-related incidents (controversy indicator includes emissions, waste, and energy, land, biodiversity and water use)

- Contractors and supply chain-related controversies or incidents

- Products- and services-related controversies (environmental and carbon impact of products and services)

- Supplier environmental programs (assessing companies’ programs to improve the environmental performance of suppliers)

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >US constituents in the STOXX® Global 1800, the parent index universe, are first screened for a minimum trading volume threshold and for an Ocean Care KPI score greater than zero. Companies with a risk level of 2 or more (in a range of 0 to 5) in the ‘Operations Incidents – Emissions, Effluents and Waste’ KPI are excluded.

Companies deemed non-compliant with Sustainalytics’ Global Standards Screening2, which tracks recognized international norms, are removed from the pre-selection list. Also excluded are those involved with the following products and business lines: controversial weapons, tobacco production, thermal coal extraction and power generation, and military contracting weapons and related products or services.

Stocks that clear these filters are ranked in descending order by their market capitalization multiplied by their Ocean Care KPI rating. The largest 40 companies in terms of adjusted market cap are selected, with each stock’s weight in the index also determined by this market size/ocean care rating multiple.

“As a company, SILEX is committed to playing a role in the preservation of the oceans,” said Xavier Laborde, CEO and co-founder of SILEX. “Encouraged by a strong response from our clients, we have developed investment solutions which aim at reducing the footprint of human activities on the oceans.”

Doing good as well as doing well

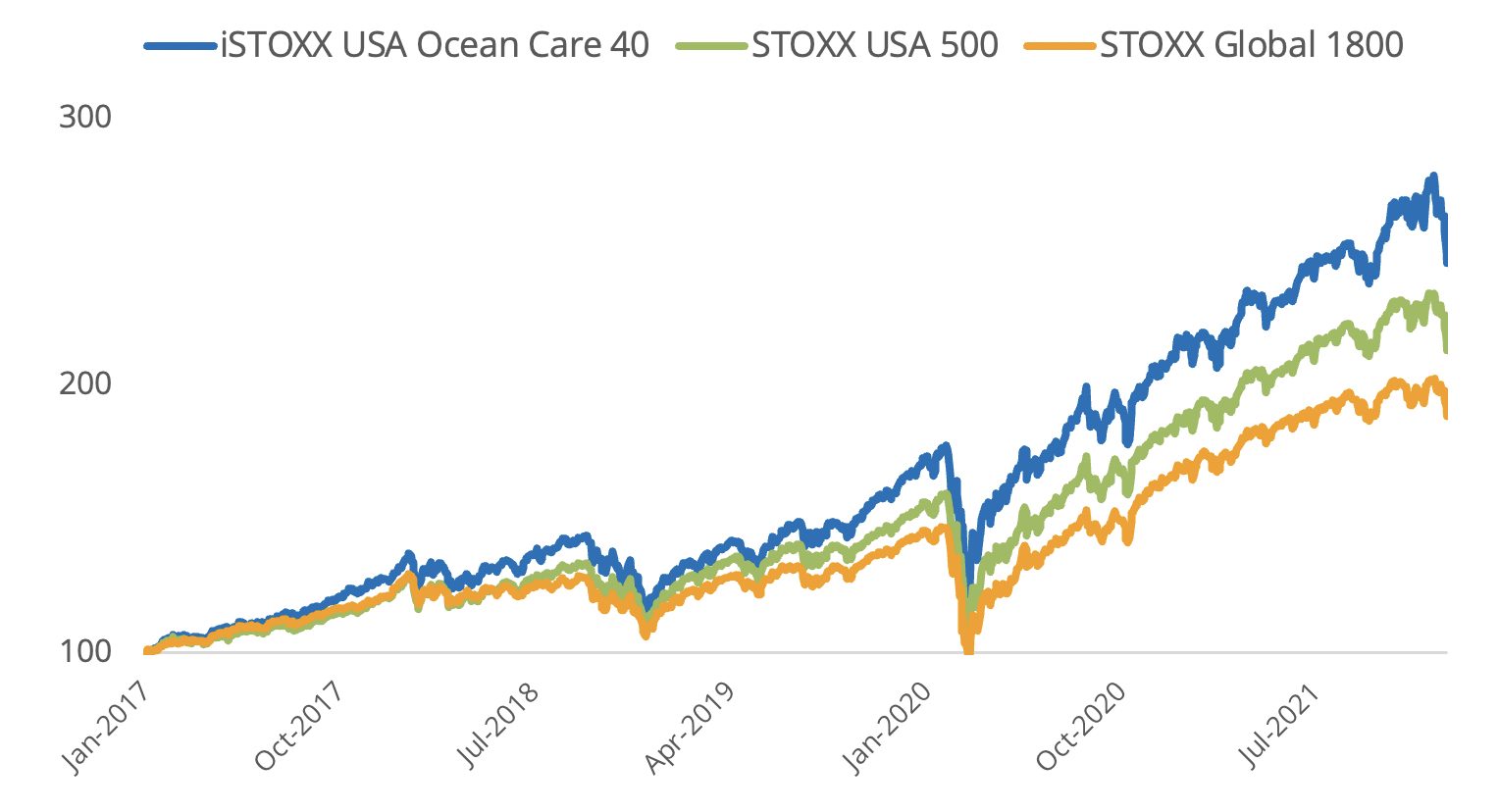

Figure 1 shows that, in the past five years, investors have outperformed by caring for our world’s waters. The iSTOXX USA Ocean Care 40 index has beaten the STOXX® USA 500 by more than 32 percentage points over the period.

Figure 1 – iSTOXX USA Ocean Care 40 index performance

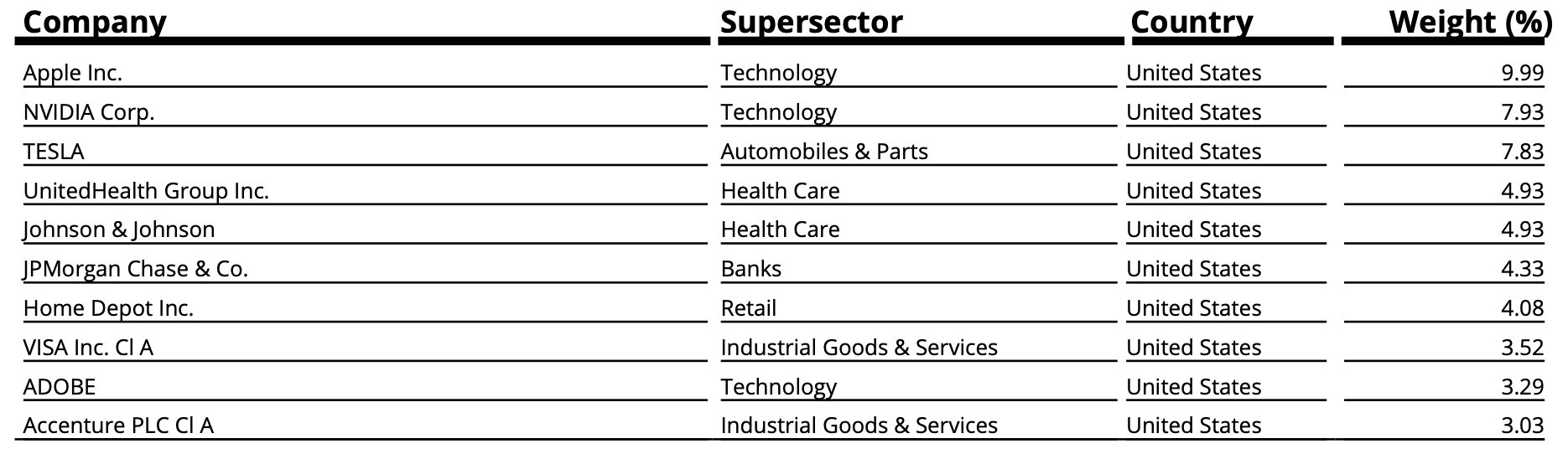

Figure 2 – iSTOXX USA Ocean Care 40 index top ten constituents

Passive approach to tackling serious problem

The effects of the water quality crisis threatening our world could be devastating. One positive point is that awareness is on the rise, and many countries are encouragingly enacting legislation and regulation to stem water pollution. More information, prevention and investments will also help solve the problem, according to the World Bank report.

Investors and businesses are also stepping up their responsible duty in managing our rivers and seas. This latest index aims to connect both actors to conduct change for this indispensable natural resource.

1 The World Bank, ‘Quality Unknown: The Invisible Water Crisis,’ Aug. 20, 2019.

2 Global Standards Screening identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the United Nations Global Compact (UNGC) Principles, the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.