STOXX Ltd. turned 25 this year, marking the passage of a quarter century that coincided with a radical transformation of financial markets and investment possibilities.

Our company started operations in 1998 with the launch of the EURO STOXX 50®, as electronic trading of equities and derivatives was gathering pace, and the introduction of the euro was still nearly a year away. The index quickly became the undisputed benchmark for Eurozone blue-chips and a barometer for the region’s economic fortunes. The creation of this benchmark and of its pan-European sibling, the STOXX® Europe 50, would pave the way for the launch in April 2000 of Europe’s first ETFs, listed at the Frankfurt Stock Exchange.

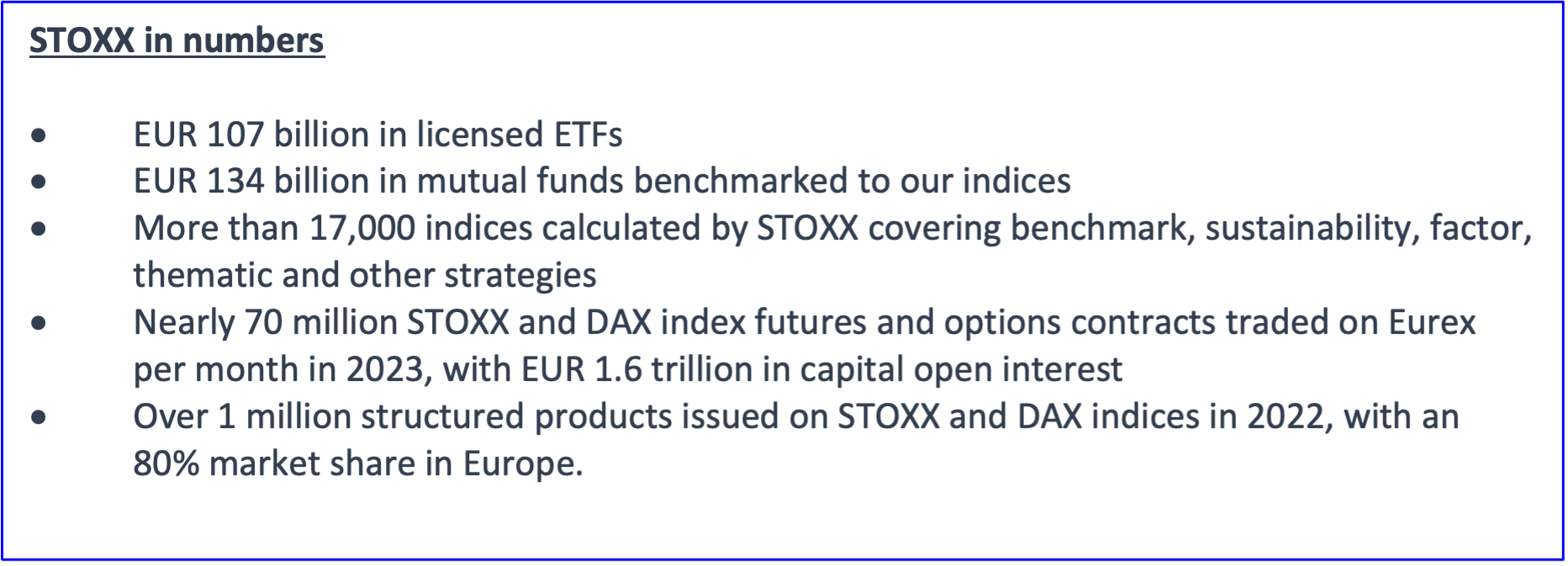

Today, we calculate more than 17,000 rules-based and transparent indices under the STOXX and DAX brands, licensed to more than 550 companies globally. These indices are used for benchmarking purposes by the world’s largest investment institutions. They also underlie some of the most liquid futures and options. And they’re the top choice for issuers of structured products.

Since day one, our indices gained rapid adoption due to their strictly rules-based and reliable methodologies. We have built a robust legacy with the most widely traded European benchmarks, whose unique and extensive ecosystem of funds, listed derivatives and structured products helps investors efficiently hedge and manage portfolios.

We are the No.1 provider of underlyings for equity index contracts at Eurex, the largest European derivatives exchange. Today, over 3 million contracts on STOXX and DAX indices change hands per day at the exchange, allowing market participants of all sizes to achieve their desired exposures and manage their investment liquidity.

European heritage, global footprint

Through the ups and downs of the European economy over the past 25 years, the EURO STOXX 50, STOXX® Europe 600 and DAX® tracked the fate of the region’s largest companies. Our indices quickly acquired a global footprint, too: the STOXX® Global 1800 Index became a popular benchmark, and in 2022 we introduced the STOXX World Equity indices. This new suite allows investors to slice and dice the world’s equity markets in a modular way, with a consistent methodology and international standards – leaving no coverage gaps or overlaps.

Sustainability moves to the fore

We have also expanded to sector, volatility, dividend and smart-beta strategies, developing some of the most groundbreaking indexing solutions.

Excitingly, the pace of innovation hasn’t slowed down, as seen with new factor-based and thematic index offerings. And increasing demand for responsible investing has led to the introduction of a comprehensive family of ESG & Sustainability indices that cater to diverse objectives. The indices have gained huge traction with investors and issuers in the past decade, and will continue to do so as regulators, investors and pensions trustees raise the bar on issues from climate to biodiversity and human rights.

The EURO STOXX 50® ESG, for example, is a variant of our flagship Eurozone index that incorporates ESG exclusions and a best-in-class strategy. In July, BlackRock unveiled an iShares ETF that replicates the index. This is the latest addition to a pioneering responsible-investing segment, which already yielded the industry-first regional sustainability-focused futures, tracking the STOXX® Europe 600 ESG-X index, in 2019.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >New technologies

As our products have evolved, our role as a company has changed along the way. Thanks to the explosion in alternative data that few imagined 25 years ago, and the consequent growth in systematic and quantitative investing, STOXX is not just an index provider, but an intelligent investments hub and innovation center.

Innovation has broadened our possibilities, enabling “smart” indices that fit bespoke mandates. With access to the most nuanced data from leading providers, and deep risk and factor exposure analysis from our partners at Axioma, we enable users to optimize their indexed portfolios — controlling for risk, returns and sustainable impact. The extraordinary progress of artificial intelligence this decade has expanded our capabilities in portfolio construction and stock selection.

Yet our mission hasn’t changed: to design powerful products, partnering with investors to tackle with precision their very specific challenges and opportunities in an ever-interconnected global economy. An open architecture that allows us to team up with the best data providers for each case gives us an edge that many of our competitors don’t have. That’s what we hear from clients and partners: they appreciate that we adapt to their needs but at the same time we uphold the accuracy, reliability and neutrality of our indices — from design to maintenance. Despite their inventiveness, all of our index solutions remain representative of the underlying market, transparent and tradeable.

While we are a leader in many segments and regions, we are a challenger in others. This requires us to stay competitive, anticipate changes, and make informed decisions. Being flexible in our offerings, adapting our products and considering clients’ unique needs are fundamental.

Combination with ISS

Just a few days ago, we took another step in our ongoing transformation journey. Our parent company, Deutsche Börse, has combined STOXX with Institutional Shareholder Services (ISS), a leading provider of ESG data, analytics and insight. STOXX and ISS have been close partners for many years, and the combination of sophisticated index know-how, market intelligence and ESG data is a perfect fit.

Under the ISS STOXX umbrella will sit the STOXX index business together with ISS Governance, ISS ESG, ISS Corporate Solutions and ISS Market Intelligence. Combining ISS’s robust and varied ESG and governance datasets with STOXX’s deep expertise in index construction will significantly strengthen the overall offering of solutions and enhance the possibilities for clients.

When passive investing turns active

Our growth has come alongside the multi-decade boom in index investing. The adoption of index-based vehicles such as ETFs has been underpinned by the multiple benefits of low cost, transparent methodologies and rules, as well as intra-day pricing and trading. Those features have made of the ETF the most efficient and favored instrument for direct investments. From a low base two decades ago, assets under management in ETFs now represent 29% of investments in active mutual funds. If one adds index-tracking mutual funds, the ratio climbs to 50% of capital invested in active funds.

At the same time, targeted strategies and customization mean that indices increasingly provide an active rather than passive investment option. The expanding functionality of such indices is likely to keep lifting the ETF universe to greater trading volumes and assets under management.

The ETF space will continue to grow as it finds new markets and applications. The objectives, construction and uses of our indices will keep changing. But whatever new products emerge, STOXX will be at the front line of change.

If the pace of change since 1998 is any guide, the next 25 years promise to bring even more innovation to the world of STOXX indices. We look forward to the next step in this journey with our clients, partners and stakeholders in the public markets.