With inflation running at multi-decade highs in most regions, many investors have turned to market segments that can better weather the punishing effects of rising consumer prices.

One such segment is real estate, which has a reputation for being at least a partial hedge in inflationary backgrounds since both rental income and property values typically correlate positively with increases in inflation.

But just how efficient an inflation hedge is real estate? A new white paper1 from Diana R. Baechle from Qontigo’s Applied Research team investigates the recent relationship between real-estate equities and inflation expectations in the US, UK and Europe to try to elucidate this question at such a crucial time.

The study focuses on the iSTOXX® Developed and Emerging Markets ex USA PK VN (‘Intl.’ Real Estate Index’). The gauge covers over 600 stocks in more than 40 countries (the US is not included).2

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Inflation as a macro factor

Using a macroeconomic risk model can inform investors how a change in expected inflation will impact their real-estate portfolio. Axioma’s Macroeconomic Projection Model helps us determine that the Intl.’ Real Estate Index, since its inception in February 2019, has shown positive average exposures to the US, Europe and UK inflation factors.3,4 This means that a rise in expected inflation has translated into a positive return for the index.

Noticeably, the index was not always anticipated to benefit from higher expected inflation — exposure to Europe inflation was negative during parts of the analysis period — but this has been the case for most of the time.

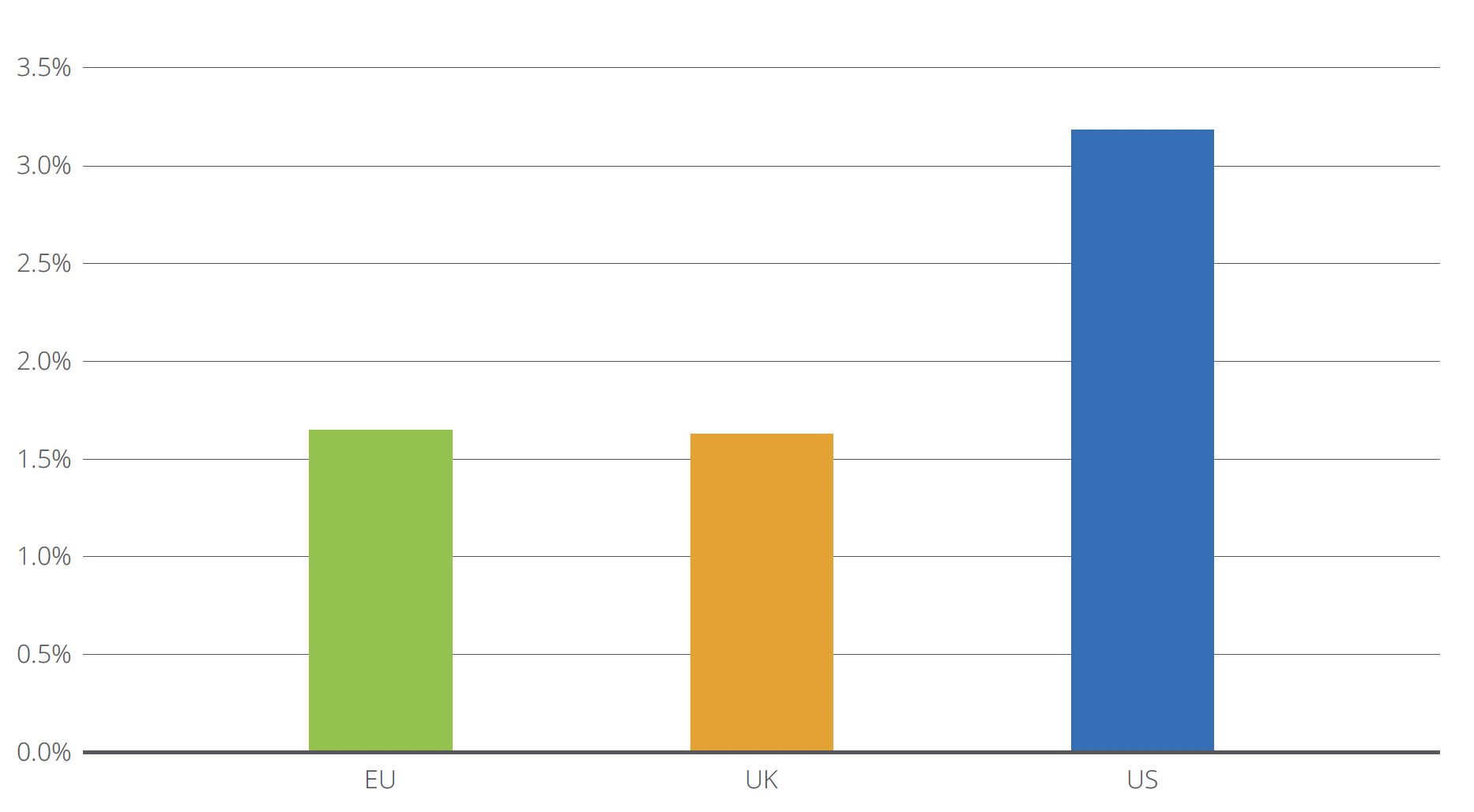

Since expected inflation has been on the rise globally in the past three years — particularly after March 2020, when COVID-19 hit — the combination of average positive exposures and the upwards changes in expected inflation resulted in a positive contribution to the Intl.’ Real Estate Index’s return in all three regions. This confirms that the index proved to be a good hedge against rising expected inflation over the entire period, Baechle writes (Figure 1).

Figure 1: Expected inflation – Contribution to the 2019-2022 index return

2022 inflationary conditions: A tale of two regimes

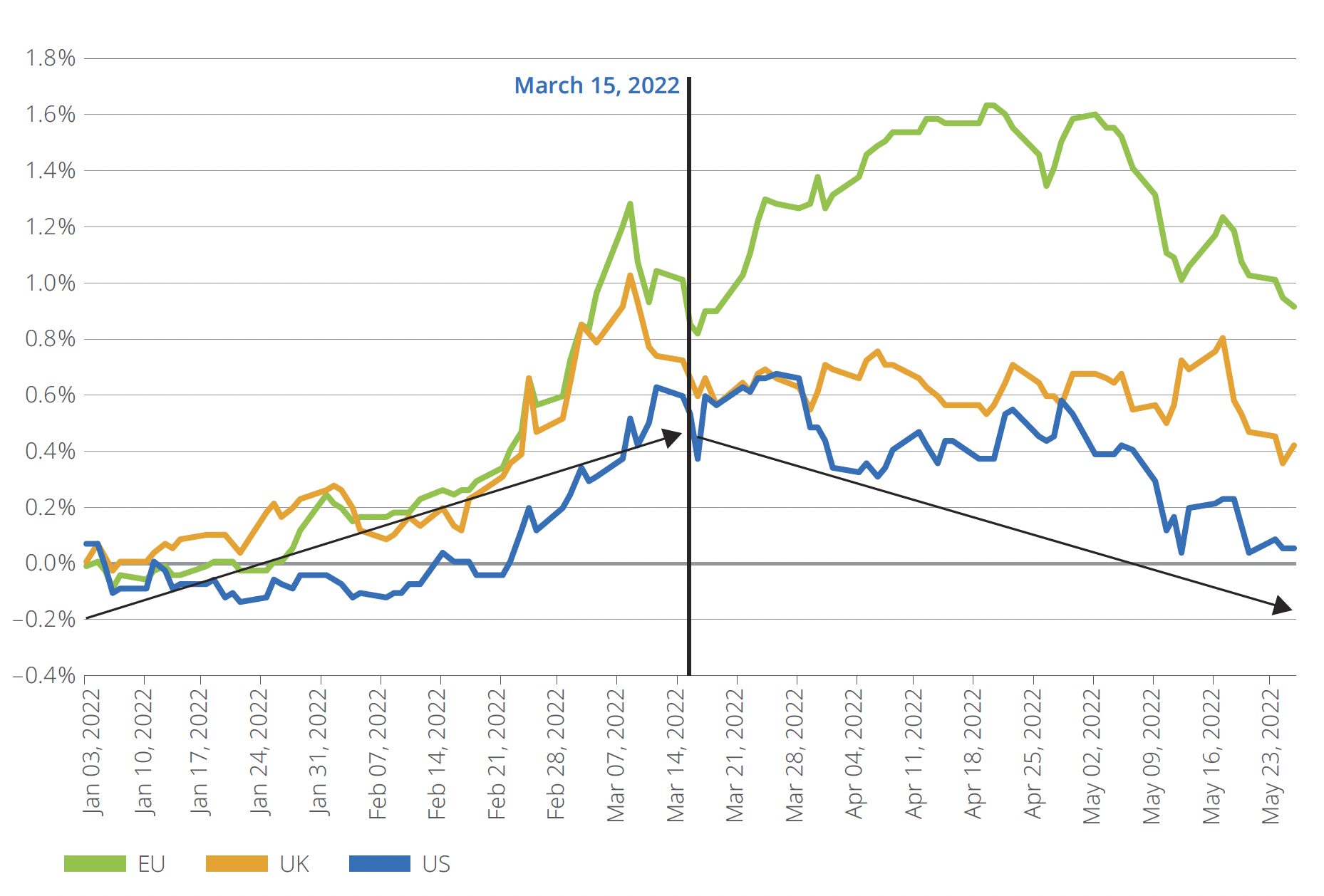

As mentioned, Baechle shows that exposures to expected inflation vary by region. Conversely, returns from the expected inflation factor also change. These are key considerations to bear in mind for inflation-focused investors.

Specifically, inflation expectations have gyrated this year. While forecasts for accelerating prices built up in 2022 up to mid-March, they declined after the Federal Reserve raised rates for the first time since 2018 on March 16 this year and the Bank of England followed suit. This change in sentiment had an impact on the returns of the inflation expectation factors in the Macroeconomic Projection Model (Figure 2).

Figure 2: Expected inflation – YTD cumulative factor return

Contribution to returns

The combination of factor exposures and factor returns translates into the contribution of each factor to index returns. The white paper shows in detail what was the index performance attributable to the expected inflation factor by region for the pre- and post-March 16 periods.

Further, the author runs a stress test on the Intl.’ Real Estate Index to determine what the impact from a 0.50-percentage point increase in each of the US, Europe and UK long-term expected inflation rates would be on index returns. The findings suggest that the index stands to gain 1.4 percentage points if US expected inflation were to rise by that much. However, an increase in either EU or UK expected inflation would impact the index negatively.

Exposure to inflation factor is key

A portfolio’s exposures to expected inflation in various regions can tell investors what to anticipate from changes in near-term expected inflation rates, as no two portfolios will react in the same way. Differences in stock holdings and, importantly, shifts in monetary policy will determine whether real-estate stocks are, or not, a good hedge against inflation expectations.

“When it comes to investing in a real-estate portfolio, it is a good idea to check whether the portfolio’s exposure to expected inflation is positive or negative before deciding if this portfolio will benefit or be hurt by higher or lower inflation expectations,” writes Baechle.

We invite you to download the white paper and read more about its findings.

1 ‘The International Real Estate Index — A hedge against expected inflation,’ Qontigo, June 2022.

2 The iSTOXX® Developed and Emerging Markets ex USA PK VN Real Estate Index represents the real-estate sector in developed and emerging markets excluding Pakistan, the US and Vietnam.

3 The inflation factor in the Macroeconomic Projection Model captures the sensitivity to daily changes in the 5Y breakeven inflation rate, and therefore represents the sensitivity to expected inflation as opposed to reported inflation.

4 A fundamental risk model computes exposures to factors for each asset in the model estimation universe. Exposures are normalized across factors, much like z-scores. An asset’s exposure to a factor denotes an asset’s sensitivity/beta/loading to a particular factor. Aggregating the exposures of each asset in a portfolio gives us the portfolio’s exposure to the factor.