Emerging markets (EMs) are supposed to be riskier than their developed counterparts. They haven’t been recently.

Leon Serfaty, CFA.

Leon is Principal at Qontigo’s Applied Research team, which provides unique insights into risk trends.

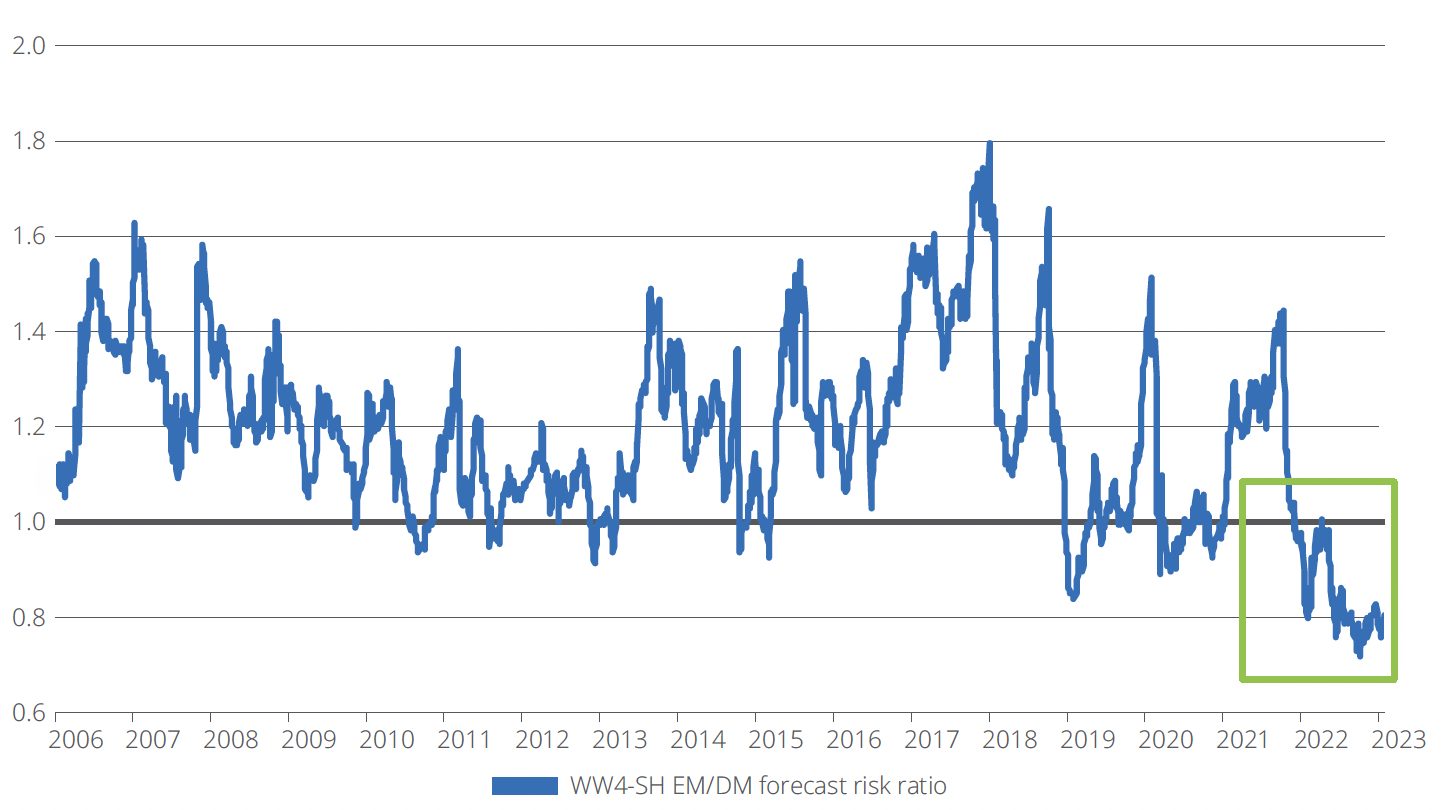

For all of 2022 and into 2023, the STOXX® Emerging Markets 1500 index has shown lower forecast and realized volatility than the STOXX® Global 1800, a benchmark for developed economies (DMs). While this ratio does invert briefly from time to time, this is the longest sustained inversion since at least 2006 (Exhibit 1).

From 2006 to the end of 2021, the median emerging-to-developed risk ratio as measured by Axioma’s forecast risk model was 1.19. Since January 2022, it has been 0.82.

Exhibit 1: Ratio of STOXX Emerging 1500’s to STOXX 1800’s short-horizon risk

Given the recent tumult in global equity markets, this is somewhat counterintuitive, particularly as the US dollar has strengthened considerably against most other currencies.

To understand what’s driving this anomaly, we can examine the components of risk and returns for both indices. Specifically, we can use the Axioma Worldwide Equity model to disentangle the effects of factor covariance on each of the indices and pinpoint the systematic risk factors that have fueled the inversion.

The results of this analysis appear in a new whitepaper.1 Some of its key findings are:

- The risk-inversion phenomenon only exists at the index level. Emerging countries display, on average, higher volatility than developed ones.

- This situation is driven by the relative diversification profiles of the two indices.

- The concentration in the DM index (namely, in US stocks) is unprecedented; its largest constituents have been the most volatile of late, upending normal expectations of market beta for both DM and EM stocks.

In the whitepaper, we unpick the components of a risk model to understand the behavior and drivers of an index’s risk — namely, the exposures or loadings of assets on factors, the return variance of the factors and the covariance of the factors with one another. Readers can then find a description of each factor that contributes to risk to understand the composition of a final risk reading.

Upheaval in market backdrop

Some of the risk inversion patterns emerged between the end of September 2021 and the beginning of December 2021, a period of substantial increase in global equity market risk. The trend continued into 2022 as inflation concerns spread worldwide, interest rates rose, Russia invaded Ukraine and global supply-chain issues persisted.

During this period, while global developed markets sold off, many large, commodity-exporting emerging markets saw domestic markets rise. Consequently, the latter went from being high beta to low beta. By contrast, the largest constituents of the DM index were, on average, down even more than the index, and thus became high-beta stocks.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >In the last 16 months, the Market Sensitivity exposure, or beta, of what is typically considered a high-risk class of equities has changed dramatically. But this is relative to a global market that is dominated by mega-cap US technology and consumer-discretionary companies, which have been severely repriced. These heavyweight stocks have been at the center of unprecedented concentration in the DM index and have reduced their diversification relative to the STOXX Emerging Markets 1500. The drawdowns in these companies have in most cases been larger than the overall drop in global markets, forcing their beta exposures to flip from low beta to high beta with very interesting implications for risk analysis worldwide.

Even if these global market leaders do not recover their former valuations any time soon, it is unlikely that their high level of return volatility will persist much longer. As it fades, we would expect the relative riskiness of emerging markets to increase once again, showing up in the volatility-related style exposures of the index and also non-negative correlations of EM Country factors to the Global Market factor.

We invite you to download the paper and explore what effect the market moves since 2021 have had on the diversification, correlation and beta of EMs (both on an index- and country-level) relative to DMs.

1 ‘Why have emerging markets become less risky than developed markets?’ February 2023.