Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Index | Portfolio Risk Management

Low Volatility Strategies: Why the Wheels Came Off (Temporarily) in 2020

A new Qontigo paper on global Low Volatility strategies compares 2020 returns with those over the longer term.

Melissa Brown discusses the STOXX® Europe 600 Paris-Aligned Benchmark Index, and the strategy driving a higher return and lower volatility than its benchmark.

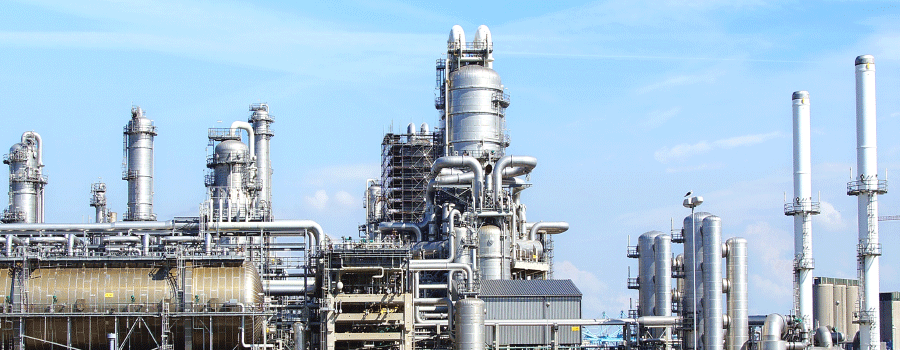

September 2018 marked the tenth anniversary of Lehman Brothers’ collapse, an event that epitomizes the traumatic happenings of 2008.

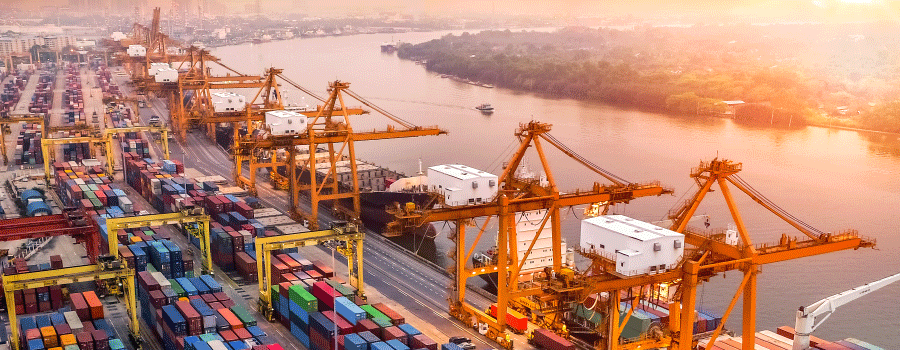

Equity markets struggled in June, led by Europe and emerging economies, as US barriers on imports raised concerns that a trade war is unfolding.

The violent market pullbacks that many traders had gotten used to living without are back. The STOXX® Global 1800 Index plunged 7.5%1 between Feb. 2 and Feb. 8, its steepest five-day decline since August 2015.

The synchronized growth witnessed in 2017 is expected to continue this year, according to economists, who say markets can weather the gradual normalization of monetary policy.

Despite the Fed’s and the ECB’s divergent trajectories, the dollar fell against the euro to $1.18 in December from $1.05 in January, confounding expectations. At the start of 2017, the average forecast from five banks pointed to the euro ending the year at $1.05.