Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

Changes were announced as part of the March regular review of the DAX 50 ESG, DAX 50 ESG+, DAX 30 ESG, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.

Index | ESG & Sustainability

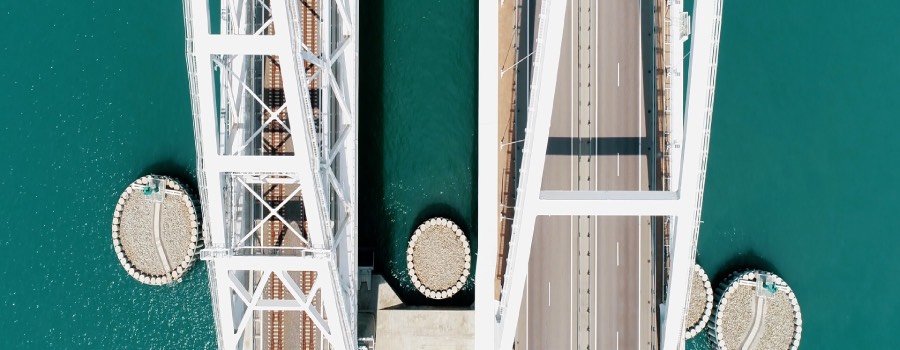

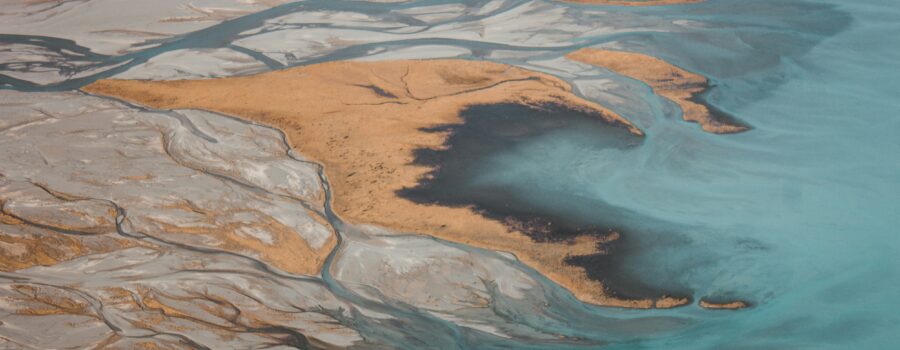

Infographic: How investors can integrate biodiversity into their financial strategies

Biodiversity plays a vital role supporting life on Earth, while contributing over half of global GDP. Yet key species continue to be lost. This infographic shows how investors can integrate biodiversity into their investment strategies.

Index | Listed Derivatives

Fifth anniversary of STOXX ESG derivatives sees broadening innovation, adoption

Five years since the launch of futures on the STOXX Europe 600 ESG-X index, the Eurex-STOXX partnership in ESG derivatives now includes nearly a dozen listed products. Volumes continue to pick up, testimony to increasing investor interest and evolving regulation in the region.

The DAX 30 ESG index is the latest introduction to a family of German ESG benchmarks. It tracks the country’s large-caps with the highest ESG scores determined by ISS ESG.

Index | ESG & Sustainability

Expert view: Unpacking the new Xtrackers biodiversity ETFs and their ISS STOXX indices

As DWS launched the Xtrackers Biodiversity Focus SRI UCITS ETFs, we sat down with experts from Xtrackers, ISS ESG and STOXX to explore what’s driving investor interest in biodiversity strategies and how they can comprehensively integrate natural-world data and considerations into portfolios.

Index | ESG & Sustainability

Q&A with BlackRock’s Moufti: Capturing the upside from essential metals miners

Omar Moufti, Thematics and Sectors Product strategist at BlackRock, says the transition to a low-carbon economy is just one of the forces propelling the copper and lithium industries, and explains why investing in the miners’ stocks may be an attractive long-term proposition for investors.

Index | Listed Derivatives

New STOXX Europe 600 SRI futures on Eurex broaden sustainable derivatives offering for investors

Eurex will launch futures on the STOXX Europe 600 SRI (Socially Responsible Investing), an index with extended exclusions as well as emissions and best-in-class ESG filters. The offering follows the successful adoption of similar contracts on the STOXX EUROPE 600 ESG-X, launched in 2019.

Demand for copper is expected to surge by around 54% between 2022 to 2050. Here are three things to know about the copper market’s future.

Lithium consumption surged by 30% in 2022, accompanied by a boost in production. Here are three things to know about the lithium market’s future.

The DAX 30 ESG index is the latest introduction to a family of sustainable German benchmarks from DAX. It incorporates negative exclusionary screens and selects large stocks with the highest ESG scores.

Watch Michael Lewis, Head of Research for ESG at DWS, Hernando Cortina, Head of Index Strategy at ISS ESG, and Antonio Celeste, Director for Sustainable Product Management at STOXX, as they discuss the significance of biodiversity, and the tools to capture natural impact in both corporate and investment strategies.

Changes were announced as part of the December regular review of the DAX 50 ESG, DAX 50 ESG+, DAX ESG Target, DAX ESG Screened, MDAX ESG+, MDAX ESG Screened and DAX indices.