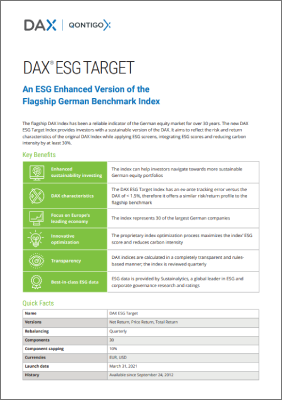

The DAX ESG Target Index provides investors with a sustainable version of the iconic DAX Index. It aims to reflect the risk and return characteristics of the original DAX Index while applying ESG screens, integrating ESG scores and reducing carbon intensity by at least 30%.

The index can help investors to navigate towards more sustainable German equity portfolios. The proprietary index optimization process maximizes the index’ ESG score and reduces carbon intensity.

The DAX ESG Target Index has an ex-ante (target) tracking error versus the DAX of < 1.5%, therefore it offers a similar risk/return profile to the flagship benchmark. It has the same number of constituents as the DAX.

The Methodology Focuses on Maximizing ESG Scores and Reducing Carbon Intensity

Index construction starts with the DAX Index and excludes companies with unfavorable ESG scores. The screening is based on Sustainalytics’ Global Standard Screening and product involvement screening for Controversial Weapons, Nuclear Power, Thermal Coal, Military Contracting, Tobacco Production, Small Arms and Oil Sands.

In the next step – the universe of the HDAX, comprised of all companies included in the DAX, MDAX and TecDAX – is taken, to replace the excluded companies to complete the number of 40 index constituents (30 up to September 20, 2021). This is achieved by ranking the screened HDAX companies in terms of free-float market capitalization and ESG score. The component weights are derived through an optimization process with the goal of maximizing the portfolio ESG Score, meeting tracking error constraints (ex-ante tracking error versus DAX < 1.5%) and carbon reduction goals. Securities are capped at 10% on a component level.

The DAX ESG Target is designed to serve as an underlying for derivatives, structured products and exchange-traded funds.

For a description of the selection methodology and the review calendar, please click here.

Whitepaper

Risk, Return and Sustainability: Qontigo ESG Target Indices Provide an Optimal Solution

Download >

Details

Top 10 Components

| SAP | DE |

| SIEMENS | DE |

| ALLIANZ | DE |

| DEUTSCHE TELEKOM | DE |

| MUENCHENER RUECK | DE |

| MERCEDES-BENZ GROUP | DE |

| DEUTSCHE POST | DE |

| INFINEON TECHNOLOGIES | DE |

| DEUTSCHE BOERSE | DE |

| BASF | DE |