DWS has launched the first ETFs tracking the new ISS STOXX Biodiversity indices, a suite that integrates nature-related risks and opportunities through a comprehensive approach.

The three new Xtrackers ETFs were listed at the Frankfurt Stock Exchange on Nov. 3 and track, respectively, the following indices:

- ISS STOXX® Developed World Biodiversity Focus SRI

- ISS STOXX® Europe 600 Biodiversity Focus SRI

- ISS STOXX® US Biodiversity Focus SRI

The indices have been designed using the ISS STOXX biodiversity framework, introduced in May this year, and integrate additional composition requirements to comply with heightened objectives and policies. They exclude companies involved in activities causing harm to biodiversity, select those with a less negative impact on ecosystems compared to peers, and those supporting relevant UN Sustainable Development Goals (SDGs). Finally, they also reduce the portfolio’s carbon emissions.

Increasing liabilities, rising opportunities

Resource exploitation, climate change, pollution and the introduction of invasive species are among the main drivers behind the rapid degradation of the world’s land and water — and an average 69% decline in wildlife population since 1970.[1] One sole industry, food production, is estimated to have caused 70% of biodiversity loss.[2]

Politicians and regulators are turning their focus to reverse this. At the 15th conference of the UN Convention on Biological Diversity (COP15) in Montreal last December, 196 states reached a landmark agreement to protect and restore 30% of the world’s land and water by 2030. For many observers, the Kunming-Montreal Global Biodiversity Framework (GBF) accord could do for biodiversity what the Paris Agreement did for climate: become a tipping point for targeted investment flows.

The move to protect our habitats raises the regulatory liabilities for corporates and investors, already facing biodiversity-related physical, transition and systemic risks.[3] The European Central bank (ECB), for example, has started considering biodiversity loss as a growing risk for the financial system. The ECB has found that approximately 72% of Eurozone companies and almost 75% of bank loans to corporate borrowers in the region are highly dependent on at least one ecosystem service.

However, biodiversity action should not solely focus on risks but also embrace opportunities, identifying companies whose products and services provide solutions to limit or reverse biodiversity loss, either directly or indirectly.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >The ISS STOXX biodiversity framework

The ISS STOXX biodiversity framework is composed of four steps working together to allocate capital to companies that minimize their biodiversity footprint and help our world’s natural resources.

Figure 1: Framework’s four steps

The “Avoid” step incorporates negative exclusions, including standard compliance and product-involvement screens, and biodiversity-related activity filters[4]. In “Minimize,” the indices select the top 80% of companies by ICB Sector with the least impact on biodiversity,[5] based on ISS ESG’s Biodiversity Impact Assessment Tool (BIAT). The “Enable” stage selects companies whose products and services grant them the highest exposure to selected biodiversity- and climate-related UN Sustainable Development Goals (SDGs).[6] A final step, “Decarbonize,” ensures the portfolio has achieved a minimum of 30% carbon footprint reduction relative to the starting universe.

Specific to the SRI indices are filters to screen out companies involved in adult entertainment, alcohol, gambling, fossil fuels and nuclear power, as well as those with the lowest ESG ratings (D-, D and D+) from ISS ESG. The ISS STOXX Biodiversity Focus SRI indices also have caps on ICB Industries and single stocks, and a stricter carbon reduction objective than the standard ISS STOXX Biodiversity indices.[7]

“New developments in sustainability data disclosure enable us to integrate biodiversity impact parameters into portfolios in a transparent and systematic way,” said Antonio Celeste, Director for Sustainability Product Management at STOXX. “This couldn’t be more timely, as the fight to protect our biodiversity has emerged as one of the next critical topics in responsible investing. The ISS STOXX Biodiversity framework offers a complete toolkit for investors to customize existing indices incorporating additional objectives and constraints.”

Impact performance

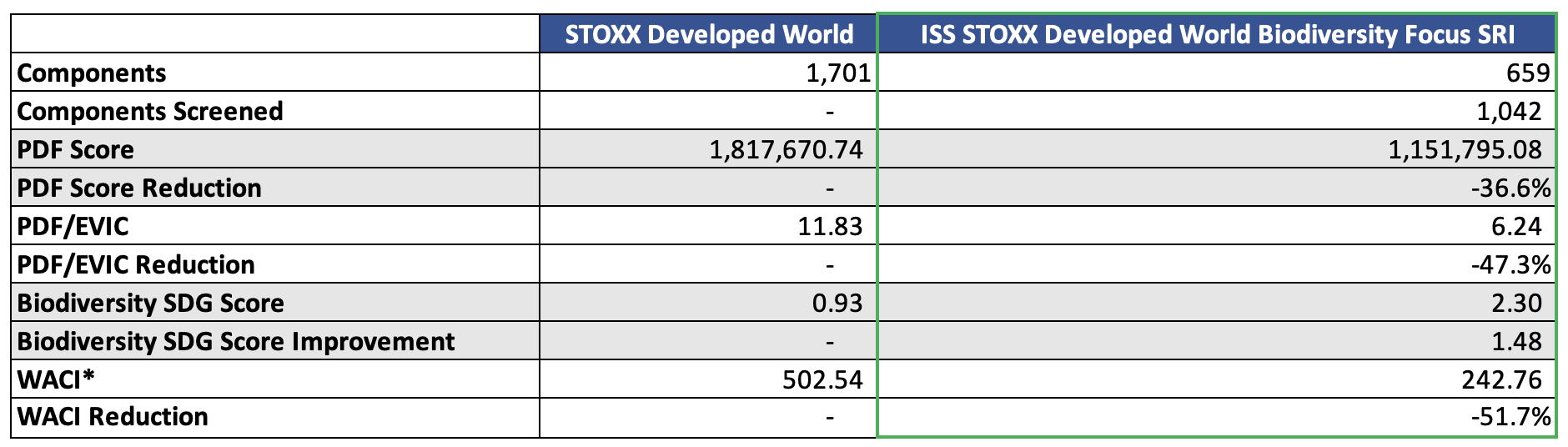

Figure 2 shows the comparative performance of the ISS STOXX Developed World Biodiversity Focus SRI index against its benchmark in a series of impact metrics. The biodiversity index managed, over the period considered, to lower its species impact score (PDF) by more than a third, significantly improve the portfolio’s SDG score and reduce its carbon intensity by half.

Figure 2: ISS STOXX Developed World Biodiversity Focus SRI Index results

For a deeper look into the ISS STOXX Biodiversity framework, please visit an article from earlier this year.

[1] See “Living Planet Report 2022,” World Wide Fund for Nature (WWF).

[2] WWF, 2020.

[3] Physical risks include the loss of raw materials and disruption of operating environments. Transition risks include policy shifts, change in market preferences and voluntary commitments. Systemic risks include global pandemics. Regulatory or litigation risks include increasing legislation.

[4] Companies that are non-compliant based on the ISS ESG Norms Based Screening assessment or are involved in Controversial Weapons are not eligible for selection. Additional exclusion filters are applied, screening companies for involvement in Palm Oil, GMO Agriculture, Hazardous Pesticides, Animal Welfare, Fur Involvement, Tobacco, Adult Entertainment, Alcohol, Gambling, Thermal Coal, Unconventional Oil & Gas, Fossil Fuels, Nuclear Power, Civilian Firearms, and Military Contracting.

[5] ISS ESG’s BIAT measure quantifies each company’s impact on biodiversity through a Potentially Disappeared Fraction of species (PDF) ratio. PDF represents — from a total preservation ratio of 0% to full destruction at 100% — the potential decline in species richness in an area over a period due to unfavorable conditions associated with environmental pressures.

PDF is divided by each company’s Enterprise Value including Cash (EVIC). The indices select the 80% companies in each ICB Sector with the lowest PDF/EVIC.

[6] The companies are assessed based on their contribution to the SDGs objectives as identified by ISS ESG’s SDG Impact Rating. The rating measures the extent to which companies are managing negative externalities in their operations across the entire value chain to minimize negative impacts, while at the same time making use of existing and emerging opportunities in their products and services to contribute to the achievement of the SDGs. This step screens out the bottom 20% of securities within each ICB Sector in the universe with the lowest biodiversity-related SDG Impact Rating aggregated score. Selected SDGS are SDG 6 – Clean Water and Sanitation (Biodiversity); SDG 7 – Affordable and Clean Energy (Climate); SDG 11 – Sustainable Cities and Communities (Biodiversity); SDG 12 – Responsible Consumption and Production (Biodiversity); SDG 14 – Life below Water (Biodiversity); SDG 15 – Life on Land (Biodiversity).

[7] While the ISS STOXX Biodiversity indices aim for a 30% reduction in carbon emissions relative to the starting universe, the objective has been raised to a 50% cut in the case of the ISS STOXX Biodiversity Focus SRI indices.