For over 25 years, STOXX has provided the most popular benchmarks for Europe’s equity markets, forming a liquid investment ecosystem that continues to grow in size and scope.

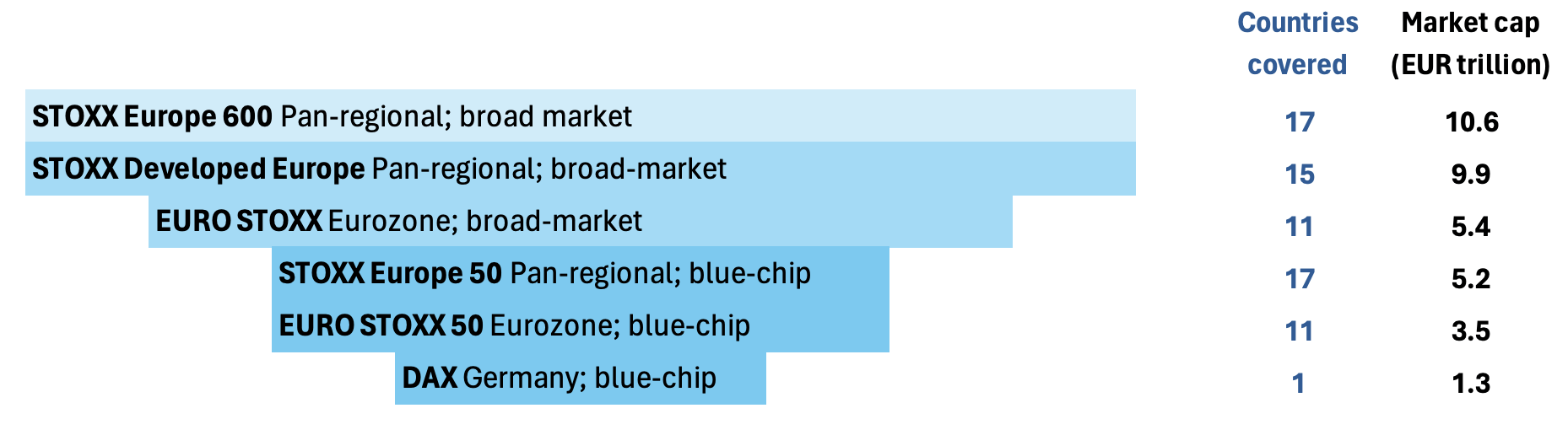

Since 1998, the blue-chip EURO STOXX 50® has been the undisputed benchmark for the Eurozone and the center of a comprehensive offering of strategy sub-indices. Its pan-European equivalent, the STOXX® Europe 50, and the broader STOXX® Europe 600 extend the trading possibilities to the entire continent. DAX® is the recognized benchmark for the German equity market.

The benchmarks gained rapid adoption due to their strictly rules-based, industry-leading methodologies, serving as barometers for the region’s economic and business fortunes. From a strategic point of view, European indices offer investors an opportunity to diversify and decorrelate global portfolios.

Figure 1: STOXX European benchmarks

Comprehensive investable ecosystem

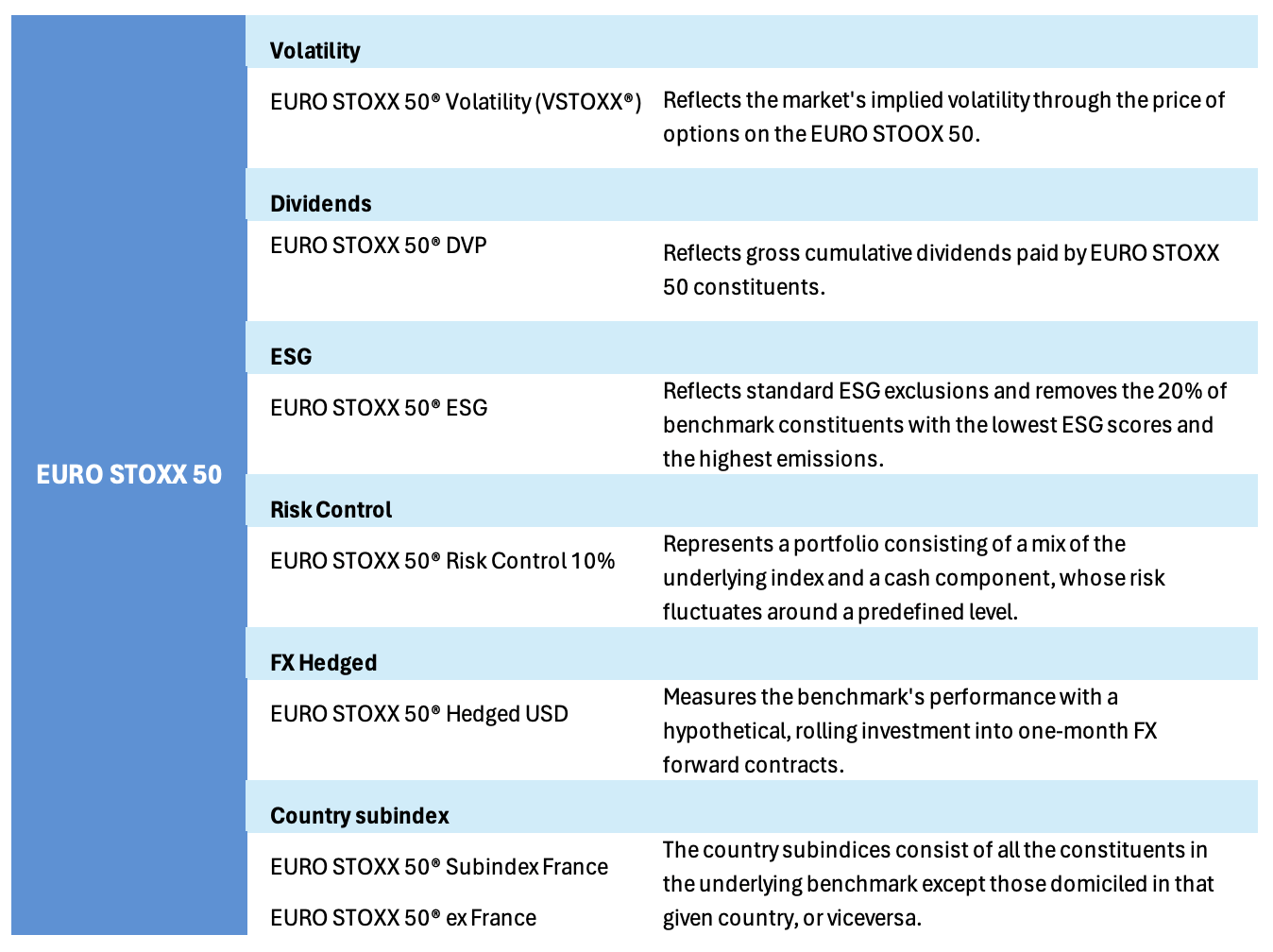

The EURO STOXX 50 is the most-followed benchmark for European equities. The index tracks the Eurozone’s Supersector leaders, offering a distinctive and diversified business exposure, and covers 11 national markets. A suite of index-based strategies around the benchmark allows investors to target specific objectives in the Eurozone equity market, including dividends, volatility and sustainability goals (Figure 2). The broader EURO STOXX and STOXX Europe 600 benchmarks also offer sector strategies.

Figure 2: EURO STOXX 50 index families

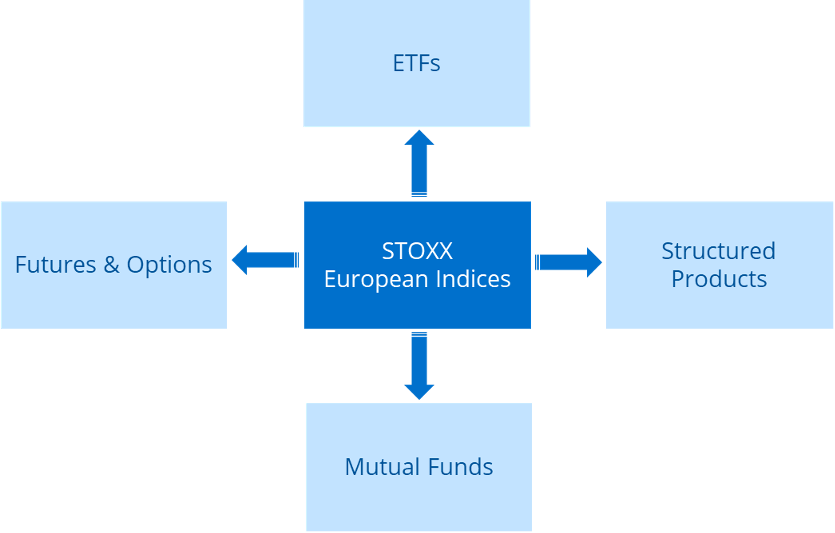

STOXX indices play an important role in ETF, derivatives and structured products markets

All STOXX indices are rules-based and transparent, representative of the underlying market, and investable. These are attributes that have attracted issuers to the indices as underlying for a wide range of products that help investors efficiently access the European equity market, hedge and manage portfolios, and channel liquidity to equity markets (Figure 3). Some highlights are:

- ETFs and mutual funds: STOXX benchmarks and their derived strategies underlie EUR 64 billion in ETFs, with over 100 funds managed by 18 investment firms.[1] Separately, more than EUR 40 billion invested in mutual funds are benchmarked to the EURO STOXX 50 and STOXX Europe 600 indices.[2]

- Derivatives: Nearly 70 million STOXX and DAX index futures and options contracts were traded per month on Europe’s leading derivatives exchange Eurex in 2023, with EUR 1.6 trillion in capital open interest at the end of the year. The EURO STOXX 50 is the most popular underlying at the derivatives exchange.

Sector strategies are also popular in the derivatives market, with the EURO STOXX® Banks index leading volumes within that category.

Total return futures and daily options have most recently enhanced the possibilities for investors and traders. - Structured products: Over 1 million structured products were issued on STOXX and DAX indices in 2022, with an 80% market share in Europe. In the strategy and custom indices category, the EURO STOXX® Select Dividend 30 led the market with a 38% share between 2019 and 2022, according to SRP. Within market-cap indices, the EURO STOXX 50 was the most popular European underlying, while the industry sector indices segment was dominated by the EURO STOXX Banks.[3]

Figure 3: STOXX European benchmarks – investable products

Sustainability moves to the fore

Increasing demand for responsible policies has defined institutional investing in recent years. Amid that trend, STOXX’s Sustainability indices have gained traction with investors and issuers and will continue to do so as regulators and asset owners raise the bar on issues from climate to biodiversity and social inclusion.

STOXX’s pioneering responsible investing segment dates back to 2001. In 2018, it was expanded with the launch of the ESG-X family, versions of established indices that exclude companies based on industry and market sustainability standards. The suite yielded Europe’s first sustainability-focused futures, tracking the STOXX® Europe 600 ESG-X index, in 2019.[4]

That same year, the EURO STOXX 50® ESG was introduced as a variant of the flagship Eurozone index that incorporates ESG exclusions and a best-in-class strategy.

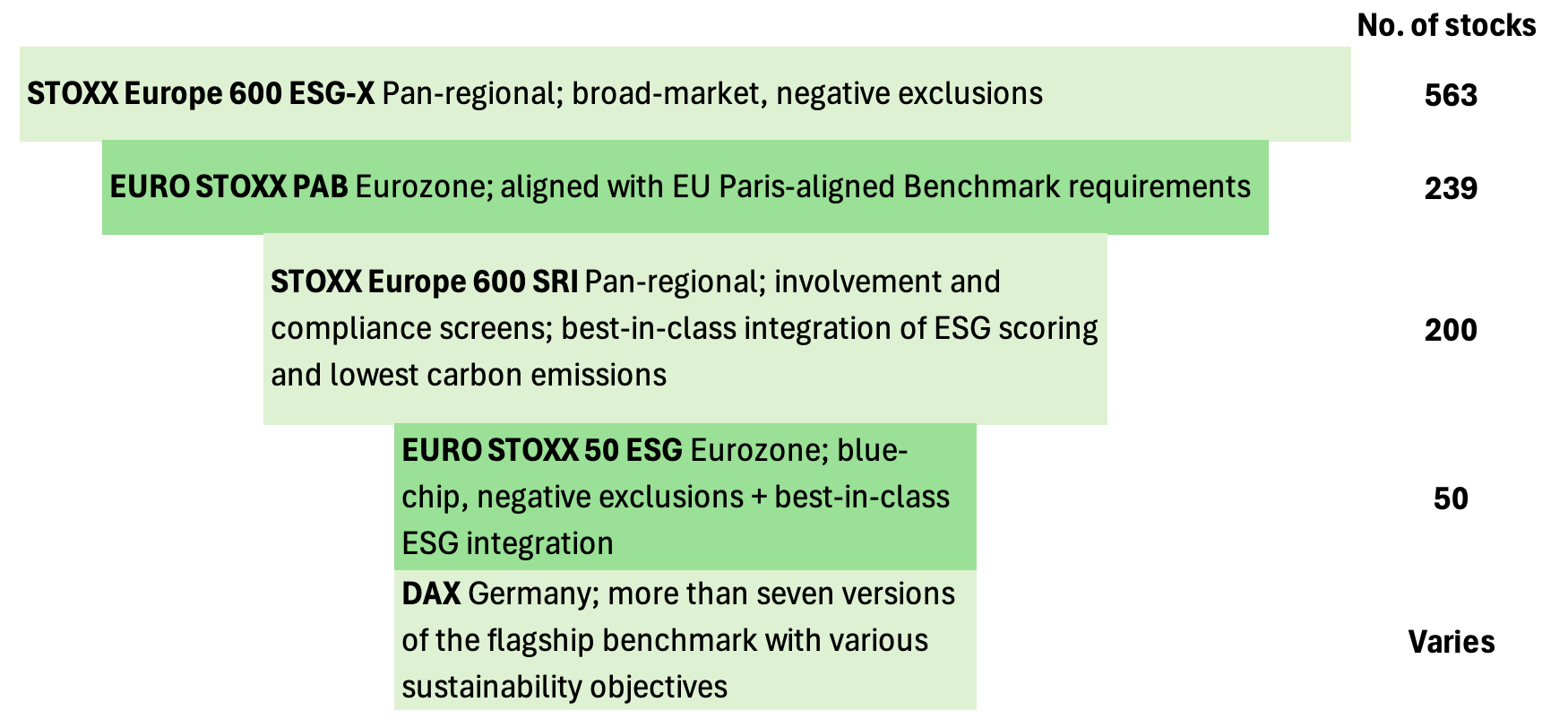

Figure 4: Key European sustainability benchmarks

Benchmarks as a starting universe for customized strategies

Driven by increased regulation, new responsible investing requirements and evolving investor needs, institutional clients, asset owners and product issuers are seeking solutions that can efficiently achieve very precise targeted investment objectives. This calls for co-developing indices in a hyper-customized interaction with clients.

Many of those collaborations have resulted in innovative solutions in exchange-traded markets. In September 2023, BlackRock introduced an iShares ETF tracking the EURO STOXX 50 ESG. The DAX® 30 ESG index, a benchmark of Germany’s large-caps with the highest ESG scores, was licensed to DZ BANK in February 2024 to issue certificates.

Benchmarks play a vital role as performance measurement tools but increasingly serve as the base upon which to serve the tailored requirements of clients, without losing the accuracy, transparency and reliability of indices.

The range of tradable products around STOXX benchmarks will continue to grow as clients choose to access the market in their preferred ways, further underpinning the liquidity, flexibility and resilience of the investment ecosystem.

Related articles

Europe’s ‘GRANOLAS’ overtake US ‘Magnificent Seven’ in performance

STOXX introduces DAX indices with UCITS-aligned and 10% stock weight caps

EURO STOXX 50 profile transformed by technology stocks’ ascent

[1] Source: STOXX, data as of February 2024.

[2] Source: Morningstar Direct, data as of February 2024.

[3] Source: SRP, Index Report 2023.

[4] Other available sustainability derivatives tied to the EURO STOXX 50 and STOXX European benchmarks include those tracking the EURO STOXX 50® ESG, EURO STOXX 50® Low Carbon, STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco, and STOXX® Europe ESG Leaders Select 30.