Qontigo has introduced the iSTOXX® Access Metaverse, a custom index designed in collaboration with Legal & General Investment Management (LGIM) that incorporates third-party data. The index underlies a new ETF from the UK asset manager.

The index was tailored to track companies with the highest business exposure to activities and technology involved in the construction of the metaverse, the virtual world of interconnected participants and consumers. The L&G Metaverse ESG Exclusions UCITS ETF was listed on several European exchanges on Sept. 7.

The metaverse can be described as the next iteration of the internet — a simulated, persistent and shared ecosystem where users live in interaction with the real world and participate in social and economic activity. It is a perceived universe, where technologies including digitalization, augmented reality and fast connectivity allow for an ever-more sophisticated representation of the physical world.

Composition of the iSTOXX Metaverse index

Index constituents are drawn from the STOXX® Global Total Market, STOXX® China ADR Total Market and STOXX® China P Chips Total Market indices, and selected in February and August every year.

The methodology picks companies that derive 20% or more of revenues from at least one of the categories below. Functional Information System (FIS), a database from research firm Syntax, is used for the categorization.

- 3D application development and augmented/virtual reality

- 5G-enabling technology

- Payment and asset services

- High-performance computing and data

- Internet of Things

- Social media and gaming

Instead of looking at each company’s primary business, as is customary with traditional classification taxonomies, FIS looks at the entity’s product line, weighted by revenue. This offers users a granular and accurate picture of every stock’s economic exposure. Qontigo’s open-architecture approach allows it to use the best data to meet client requirements, as was the case here with inputs from LGIM and Syntax.

ESG exclusions

In addition, the iSTOXX Access Metaverse screens out companies involved in activities deemed undesirable from a sustainability perspective. This includes those in breach of global norms as identified by Sustainalytics. Also excluded are companies that obtain sales from Controversial Weapons, Tobacco, Conventional and Unconventional Oil & Gas, Thermal Coal, Nuclear Power, and Small Arms and Military Contracting.

As of Sept. 5, 2022, the index had 52 components.

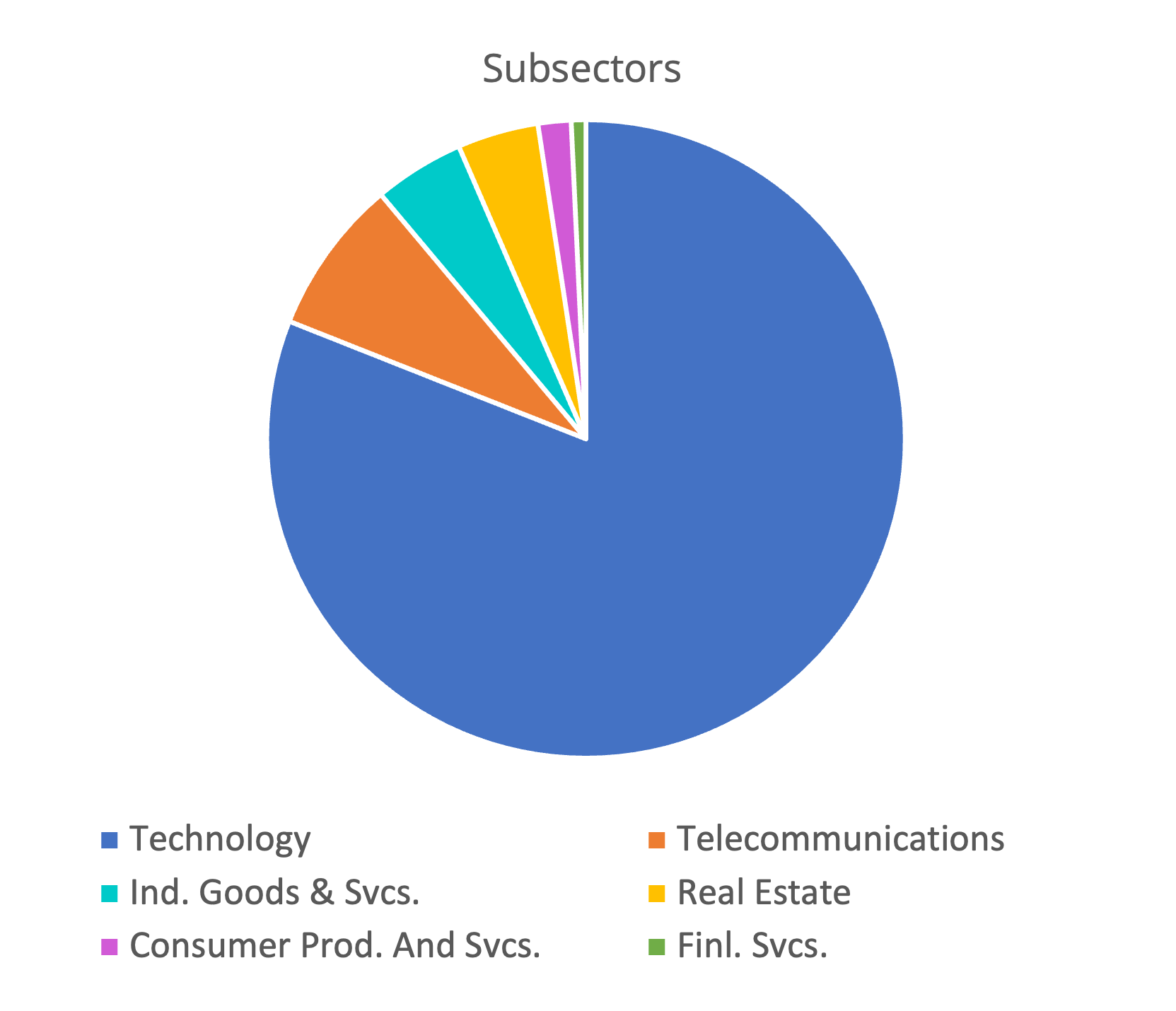

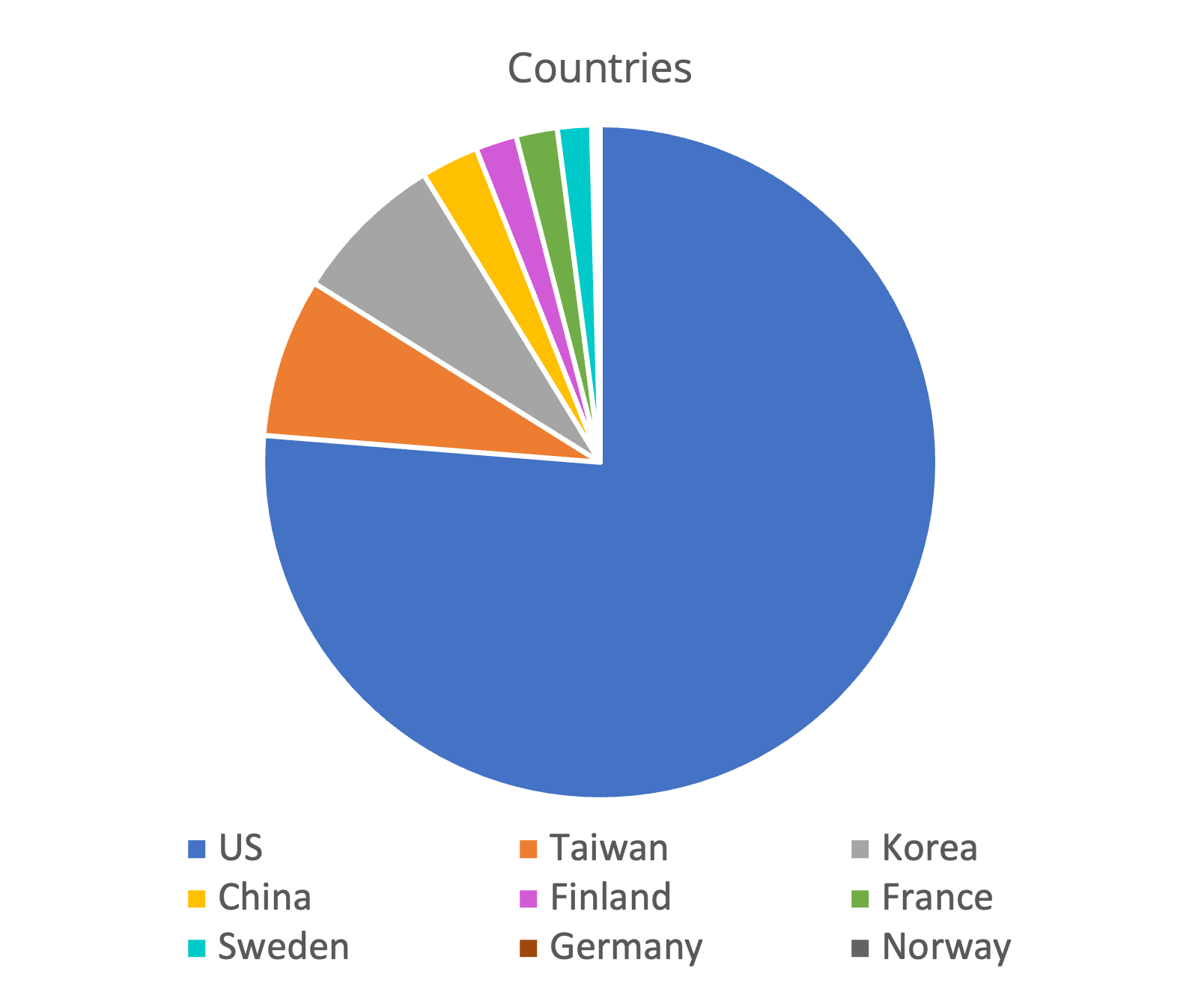

Exhibit 1: iSTOXX Access Metaverse country and subsector exposure

Targeted portfolios

Thematic indices offer investors a rules-based way to track the beneficiaries of structural and disruptive trends defining our modern world, through a systematic, objective and transparent methodology. The result is a targeted portfolio that would be difficult to achieve with sector-based approaches, an outcome that has proved popular with investors in recent years.