Germany’s Landesbank Baden-Württemberg (LBBW) has licensed the iSTOXX® Global Climate Change ESG NR Decrement 4.5% from STOXX Ltd., Qontigo’s index provider, an index that complies with the European Union Climate Benchmarks regulation, to issue structured products.

The new index is a decrement version of the iSTOXX® Global Climate Change ESG Index, itself based on the STOXX® Global 1800 Paris-Aligned Benchmark (PAB) and supplemented by additional exclusions (ESG filters). The STOXX PABs are constructed to follow the EU’s Paris-Aligned Benchmark (EU PAB) requirements and meet provisions on decarbonization trajectory, activity exclusions and sector exposure constraints. They use ISS ESG carbon, emission targets, climate risk and tobacco producers´ data, as well as exclusionary screens for global standards and controversial weapons involvement based on Sustainalytics’ information.

For a detailed description of the methodology, visit the iSTOXX index guide.

Specifically, the iSTOXX Global Climate Change ESG NR Decrement 4.5% replicates the performance of its benchmark assuming a constant markdown of 4.5% per annum, accruing daily. NR (net return) indices include all dividends paid by constituent companies, after tax.

“Sustainability is an integral part of LBBW’s corporate strategy and business policies, and is core to the product suite we seek to offer clients. In this sense, we are excited we will be expanding our broad sustainability menu with a new global climate change index underlying for structured products that gives investors the opportunity to combine a diversified worldwide equity investment with ESG aspects.”

Jan Krueger, Head of Equity Markets at LBBW

In 2019 LBBW became the first German universal bank to sign the Principles for Responsible Banking (PRI). LBBW as a business has received positive grades from leading ESG rating companies.

Transparent rules to foster low-carbon investments

The EU’s Climate Benchmark framework was devised to foster and bring harmonization to climate-aware investments, and avoid greenwashing. To achieve the PAB denomination, indices must meet the following criteria:

- Reduce the overall greenhouse gas (GHG) emission intensity by 50% relative to their underlying investment universe or parent index.

- Be sufficiently exposed to sectors with high impact on climate change.

- Be able to reduce their own GHG emission intensity by at least 7% on average every year.

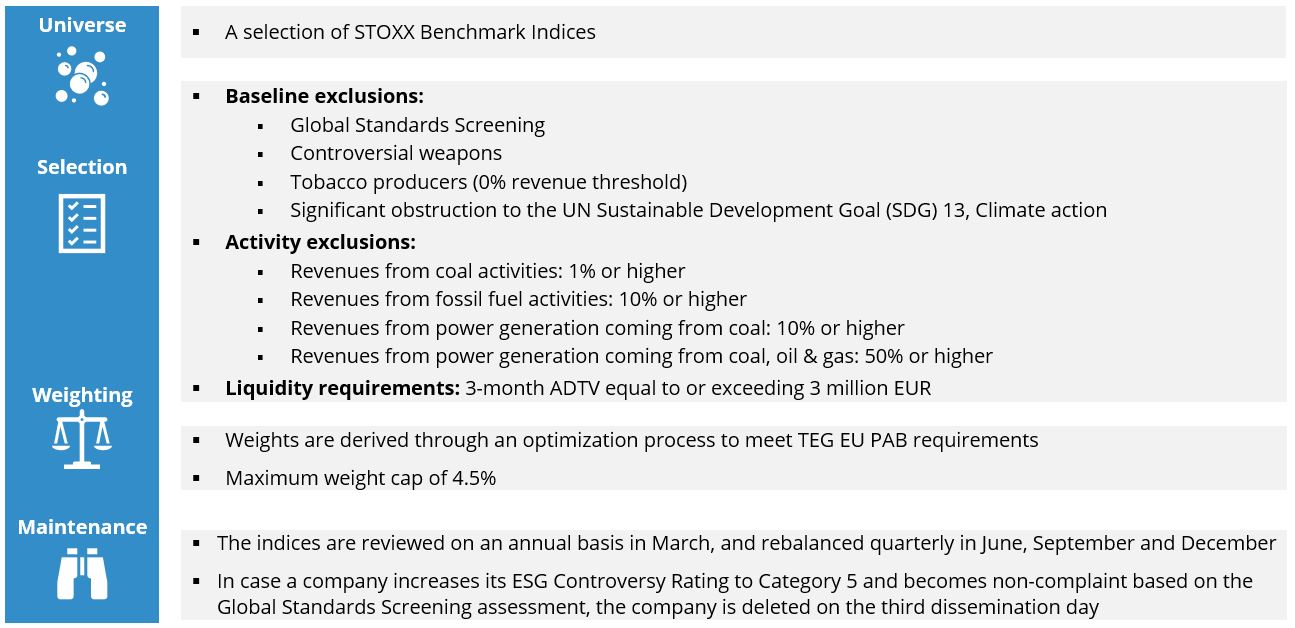

- Exclude companies involved in controversial weapons and tobacco, or deemed in breach of global norms (See Figure 1). PABs should additionally exclude companies that derive pre-determined revenue thresholds from activities in coal, oil and natural gas.

- Companies that set science-based decarbonization targets can have their weight in the PAB index increased.

Figure 1: STOXX Paris-Aligned Benchmark Indices methodology

The iSTOXX Global Climate Change ESG NR Decrement 4.5% is also compliant with Germany’s Verbaendekonzept sustainability classification.

Structured products

Decrements, meanwhile, have become a staple of the structured-product industry. Traditionally, structured-product investors are exposed to the price returns of the underlying through so-called synthetic replication. Any dividends paid during the lifetime of the structured product go to the issuer, who holds the underlying assets as a hedge. The expected value of these dividends is embedded into the pricing of the product, increasing investor benefits such as a higher coupon or better capital protection.

The decrement mechanism helps issuers hedge dividend risk. It involves deducting a pre-determined amount in absolute or percentage terms from the underlying’s level or total return on a daily basis. By selling a structured product based on a total-return index with a decrement, the issuer is basically protected against dividend shortfalls. The investor, in turn, benefits from better pricing terms.